Your Trusted Mortgage Partner in California

Licensed mortgage lending, real estate brokerage, and legal case funding. Get pre-approved for your home loan with First Rate Mortgage Inc., California's most trusted financial services provider.

Mortgage Solutions

Choose from our comprehensive range of mortgage products designed to meet your unique financial needs and goals.

Residential Loans

Conventional, FHA, VA, and Jumbo loans tailored for California homebuyers. Flexible terms from 10-30 years with competitive rates.

- Conventional Loans

- FHA Loans

- VA Loans

- Jumbo Loans

Commercial Loans

Financing for California businesses and investors. Flexible loan structures with competitive rates for commercial property purchases.

- 5-30 Year Terms

- Balloon Structures

- Investor Loans

- Development Funding

Refinancing

Smarter refinancing for better rates and cash flow. Lower your monthly payments or tap into your home's equity.

- Lower Interest Rates

- Cash-Out Refinancing

- Adjustable to Fixed

- Rate Reduction

Loan Process

Our streamlined process makes getting a mortgage simple and transparent. From application to closing, we guide you every step.

- Pre-Approval

- Documentation

- Underwriting

- Closing

Not sure which loan is right for you? Our experts are here to help.

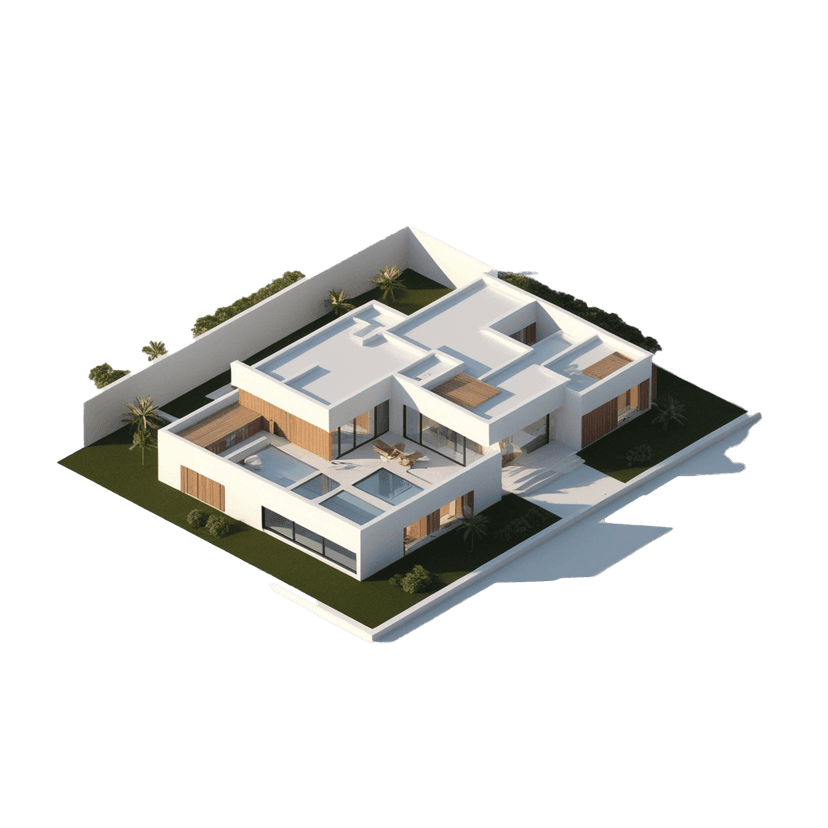

Real Estate Services

Comprehensive real estate solutions designed to meet your every need, from buying and selling to transaction coordination and property valuation.

Helping California Buyers Find — and Finance — Their Homes.

We represent buyers at every stage: property search, negotiations, inspections, and closing.

With FRMI, you get the unique advantage of real estate guidance and mortgage expertise under one roof.

We simplify the process, saving you time, money, and stress.

Maximize Your Property Value With Expert Representation.

We provide professional listing, staging, and marketing strategies to maximize your property's value.

Our agents combine local market insight with brokerage and lending knowledge to attract the right buyers.

You get a streamlined sale, from pricing to escrow closing.

Seamless Transactions, From Start to Finish.

Paperwork, deadlines, escrow, and compliance — we coordinate every step to keep your transaction on track.

Our team ensures seamless communication between buyers, sellers, lenders, and escrow officers.

You stay informed while we handle the complexities.

Know Your Property's True Worth.

Whether buying or selling, accurate property valuation is critical.

We provide comparative market analysis and coordinate professional appraisals.

With FRMI's insight, you make decisions with confidence and clarity.

One Platform. Two Services. Endless Value.

Why juggle multiple companies when FRMI offers both mortgages and real estate brokerage in one place? Our integrated model means fewer delays, better communication, and a smoother experience.

Frequently Asked Questions

Get answers to common questions about mortgages, real estate, and our integrated services.

Still have questions? We're here to help!

Call us toll-free: (888) 252-0052

Ready to Get Started?

Let us help you with your real estate and mortgage needs.

Get In Touch

We will get back to you within 24 hours.